Remember that regardless of your past credit history, you still need a car, want a car, and most importantly, you deserve a car. They also need to be treated with respect and have choices.

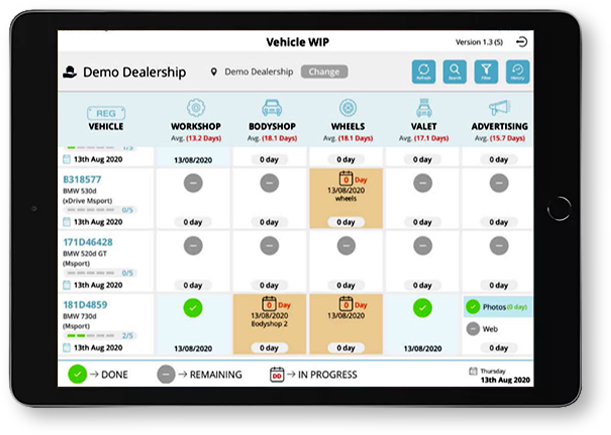

First of all, all lenders now buy deals based on what they call a flare, which is synonymous with your credit score. There are three credit bureaus that compose the package. Each lender will choose which credit bureau they prefer when considering your loan or credit bureau combination. You can also avail the benefits of the used car reconditioning online app to buy used cars.

In order to use auto finance effectively with a credit bureau, you need to know what your credit rating looks like and what your credit rating actually looks like. Otherwise, you are working in the dark.

Pay for a credit check or it will just go to waste. A credit rating tells you whether you qualify for a lender like Ford. Also, the higher the score, the lower the interest rate. In the case of a car loan with a bad credit bureau, the higher the score on the beacon, the better.

Let me explain sites like cars.com and the like: they collect car loan applications online. Then they have a network of dealers who pay them for potential customers. This is usually a dealer whose department specializes in your financing regardless of your credit rating. These departments pay for these prospects, so most of them take them very seriously because they are their bread and butter, so to speak.