Image Source: Google

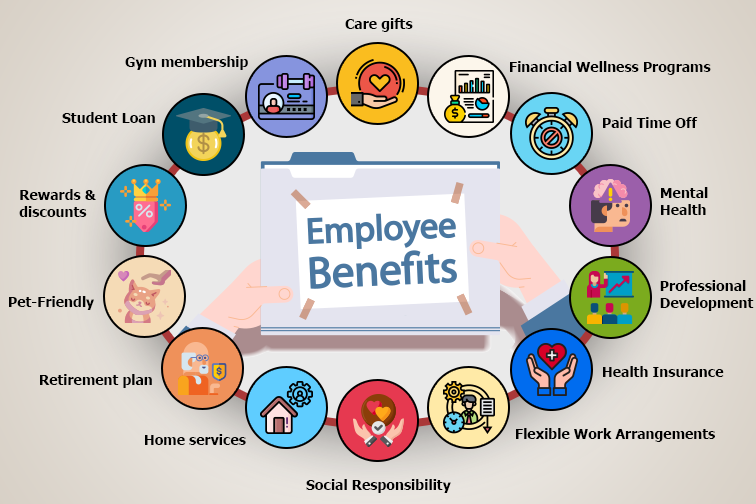

Employee benefits plans are an essential part of any company's compensation package. These plans not only help attract and retain top talent but also enhance employee satisfaction and overall well-being.

With the rising costs of healthcare and the complexities of insurance plans, businesses must partner with leading insurance brokerage firms to design and implement comprehensive employee benefits packages. In this ultimate guide, we will explore tips and insights from some of the top brokerage firms in the industry to help you create a robust employee benefits plan for your organization.

One of the first steps in creating a successful employee benefits plan is to understand the needs and preferences of your workforce. The professionals at leading insurance brokerage firms emphasize the importance of conducting regular surveys or focus groups to gather feedback from employees regarding their desired benefits. By involving employees in the decision-making process, companies can tailor benefits packages to meet the specific needs of their workforce, thus increasing employee satisfaction and engagement.

Another crucial aspect of designing an effective employee benefits plan is to stay informed about the latest trends and innovations in the industry. Leading insurance brokerage firms employ experts who continuously monitor the market and regulatory changes to ensure that their clients are offering competitive and compliant benefits packages. By staying ahead of the curve, businesses can make strategic decisions that not only benefit their employees but also help control costs and mitigate risks.

When it comes to selecting the right insurance products for your employee benefits plan, it's essential to work with a brokerage firm that offers a wide range of options from top insurance carriers. This allows businesses to customize their benefits packages based on their budget and employee needs. Leading brokerage firms have established relationships with multiple carriers, giving them access to a diverse portfolio of products, including health insurance, dental insurance, vision insurance, disability insurance, and more. These firms can help businesses navigate the complexities of the insurance market and select the best options for their specific requirements.

Moreover, leading insurance brokerage firms emphasize the importance of providing comprehensive communication and education to employees about their benefits packages. Many employees may not fully understand the value of their benefits or how to maximize their coverage. By offering clear and accessible communication materials, such as brochures, videos, webinars, or one-on-one consultations, businesses can help employees make informed decisions about their benefits and utilize them effectively. This not only enhances employee satisfaction but also helps reduce administrative burden and potential misunderstandings.

Furthermore, leading insurance brokerage firms recommend that businesses regularly review and evaluate their employee benefits plans to ensure they remain competitive and cost-effective. Market conditions, regulatory changes, and workforce demographics can all impact the effectiveness of benefits packages over time.

By conducting periodic audits and benchmarking exercises, companies can identify areas for improvement and make necessary adjustments to their benefits offerings. This proactive approach not only demonstrates a commitment to employee well-being but also helps businesses stay ahead of the competition in attracting and retaining top talent.